| Retail investor demand continues rising sharply, supported by reduced interest rates, tighter supply and greater vendor realism in valuations | M&S strengthens its UK logistics network with a major pre-let hub in Avonmouth, backed by significant long-term investment. | Office take-up in Big 6 cities remains broadly aligned with five-year averages, with standout growth in Bristol and major Manchester deals |

Retail investment activity strengthens

Recent data suggests that investment in the retail sector is showing strong signs of recovery.

Rightmove tracks property enquiries made to commercial agents and found that investor demand in retail property rose by 30% annually in Q3. Meanwhile, supply of retail property decreased by 2% over this period. This builds on momentum from Q2, when investor interest increased by 35% year-on-year.

In Q3, retail investor demand in the high street was up by 45% year-on-year. Although this is a slight dip from the 56% annual increase seen in Q2, it still indicates strong investor confidence.

Andy Miles at Rightmove commented on the data, “There can be little doubt that reductions to the base rate are enabling investment in the retail sector. But that is only part of the story. Vendors are also increasingly realistic about the value of their retail properties and the occupational market is improving somewhat.”

M&S pre-lets major new logistics hub

A £74m new logistics hub is currently under construction for M&S near Bristol.

The 390,000 sq. ft facility is being developed by Epta Development Corporation (EDC) in partnership with property developer Stoford, marking EDC’s first investment in the UK.

The project has been forward-funded by real estate investor, LondonMetric Property and pre-let to M&S on a 20-year lease, reflecting the retailer’s long-term commitment to increasing its supply chain capacity. The new unit is expected to be completed by summer 2026.

This news coincides with M&S opening a major new store in Cabot Circus, central Bristol, further marking the company’s growing presence in the West of England.

Dan Gallagher, joint managing director at Stoford, commented, “The project demonstrates confidence in Avonmouth as one of the UK’s most important distribution locations and will provide LondonMetric and M&S with a facility that meets the highest standards of design and sustainability.”

Office take-up in the Big 6 cities

Savills estimates that office take-up across the Big 6 regional cities will reach approximately 3.85 million sq. ft by the end of 2025.

The Big 6 regional cities are Birmingham, Bristol, Edinburgh, Glasgow, Leeds and Manchester. Take-up in these areas reached 948,771 sq. ft between July and September, which is 6% lower than the five-year average for Q3. However, cumulative take-up for the first three quarters is in line with the five-year average, at 2.68 million sq. ft.

Bristol has shown particularly strong growth with take-up of 227,767 sq. ft in Q3, representing a 164% year-on-year increase. This surge was driven by Hargreaves Lansdown securing a 90,362 sq. ft deal. Meanwhile, Manchester saw the largest single deal of the year to date, with Autotrader signing a 130,000 sq. ft lease.

Professional services and the technology, media and telecoms (TMT) sector dominated demand across the regions, accounting for 19% of total take-up.

Commercial property outlook

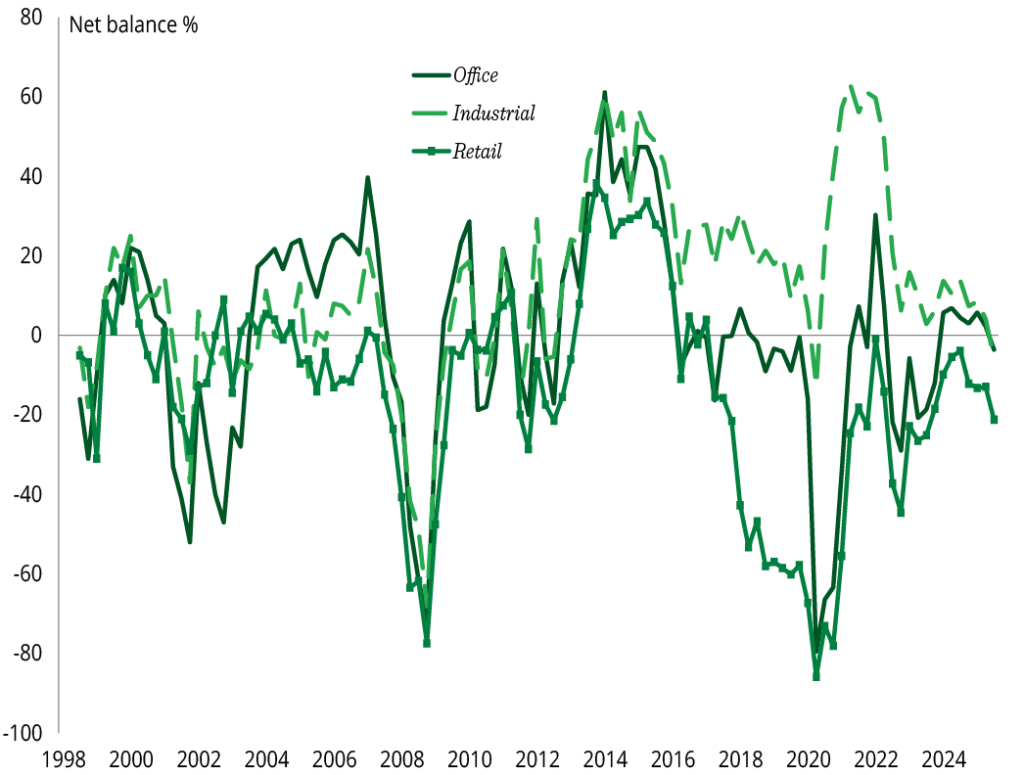

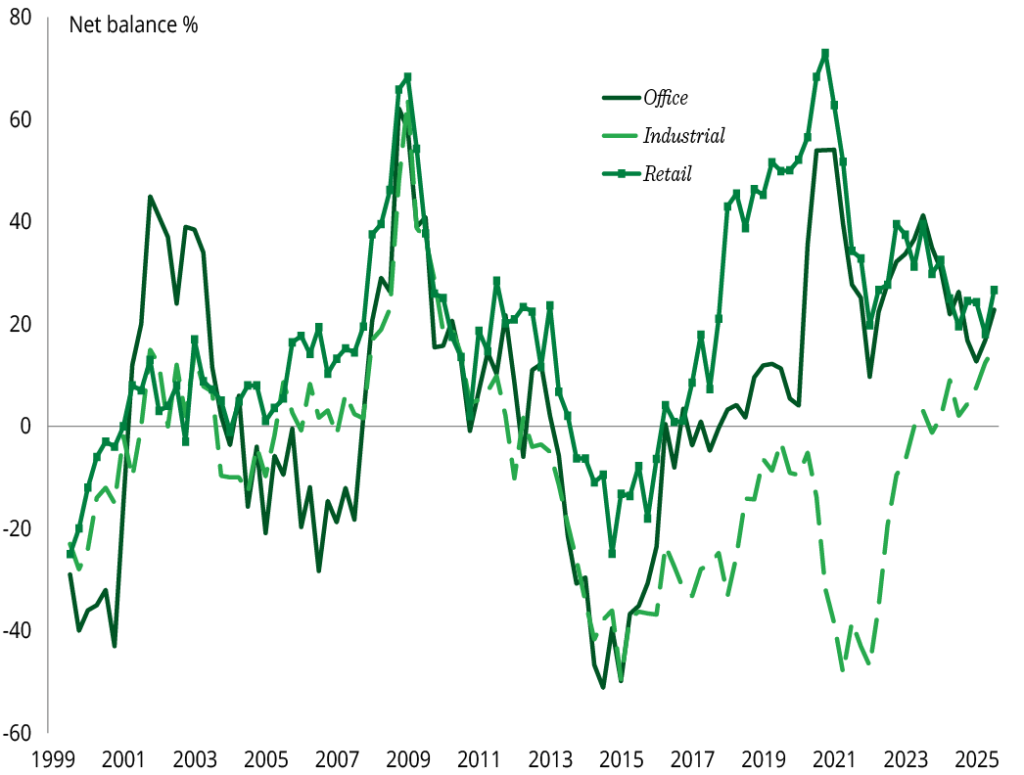

Occupier demand – broken down by sector

- Tenant demand fell during Q3, posting a net balance of -10% at the all-property level

- Retail demand saw the steepest decline (in net balance terms), registering a figure of -21%

- The corresponding readings for the office and industrial sectors were -4% and -6% respectively.

Availability – broken down by sector

- Availability of leasable space rose across all mainstream sectors over Q3

- Landlords continued to increase the value of incentive packages across all sectors

- The Q3 readings signal a flatter picture ahead.

Source: RICS, UK Commercial Property Monitor, Q3 2025

Food and beverage brands dominate London demand

Food and beverage (F&B) brands lead demand for retail space in London, according to research from Colliers.

In Q3, F&B operators accounted for 137 out of 330 total retail space requirements, outpacing other traditional retail sectors. Fashion and accessories brands followed with 57 requirements, while leisure operators accounted for 52. This marks the seventh consecutive quarter that F&B brands have led demand in the capital.

Over the first three quarters of the year, a total of 937 retail space requirements were recorded, up from 666 in the same period in 2024. Brands from the USA and Italy are driving the demand for space, accounting for 15 and 11 requirements respectively in Q3.

Paul Souber from Colliers commented, “London’s retail and F&B landscape has seen an influx of new entrants over the past five years. The city continues to refine its offering, creating a vibrant, globally appealing environment for shopping and leisure.”

All details are correct at the time of writing (19 November 2025)

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK.