| Office demand stays strong — investors favour offices, though tenants are more selective on location | Retail outperformed in 2025 — strong occupier markets and highest total returns, with investment volumes expected to pick up in 2026 | House prices expected to rise 2% in 2026, with stronger growth outside London and the South |

Commercial property trends for 2026

With the new year underway, what does 2026 have in store for the commercial property market? Property experts Savills have shared their predictions.

There was much uncertainty in the months running up to the Chancellor’s Budget in November 2025. Now that the announcement has happened, it’s likely that the market will stabilise as investors and businesses proceed to make informed decisions about their transactions. Despite this, Mat Oakley, Director of Commercial Research at Savills, noted that “the environment for economic growth remains sluggish.” However, this is not expected to have the usual downward effect on occupational activity, due to limited supply and construction activity.

Overall, offices are on track to be the most popular among investors this year. Tenants are increasingly selective about location. Meanwhile, the rapid growth of the AI sector makes it likely that competition for data centre sites will increase further this year.

A review of the retail sector

A report from Knight Frank shows that the retail sector performed well last year despite weak macro-economic growth.

In 2025, retail was the best-performing property asset class, recording a total return of 9.6%. This is much higher than the overall average of 6.6% for all property. Shopping centres and food stores delivered the highest returns (both 10.2%), just ahead of retail warehousing (9.8%).

Stephen Springham, Head of UK Markets at Knight Frank observes that “retail occupier markets are arguably in their best state for over a decade.” However, this has not yet been reflected in the investment market. Total retail investment volumes for 2025 are estimated to come in at £5.83bn, down 17% on the previous year and 8% lower than the 10-year average. Volumes are likely to pick up this year, as a number of significant shopping centre deals were agreed at the end of 2025.

Investment in UK hotels dips

Recent data from Savills shows that UK hotel investment dipped in 2025.

It is estimated that UK hotel investments reached £5bn last year, which is down 15% when compared with 2024. However, this is in line with the ten-year average of £4.7bn.

There was strong activity towards the end of 2025, with hotel investment volumes exceeding £2bn in Q4, 40% higher than the same period in 2024. Portfolio transactions declined from £3.1bn in 2024 to £750m in 2025.

Head of Hotel Capital Markets at Savills, David Kellett, commented, “UK hotel transactions proved resilient in 2025 driven by a liquid single asset market, and the enduring appeal of London, which had its strongest year of investment volumes since 2018. Despite continuing cost challenges for hospitality businesses, we anticipate a strong year ahead in 2026 with more portfolio deals, building on the positive momentum in the fourth quarter of 2025.”

Market predictions for 2026

What’s in store for the residential market this year? Rightmove has shared its predictions.

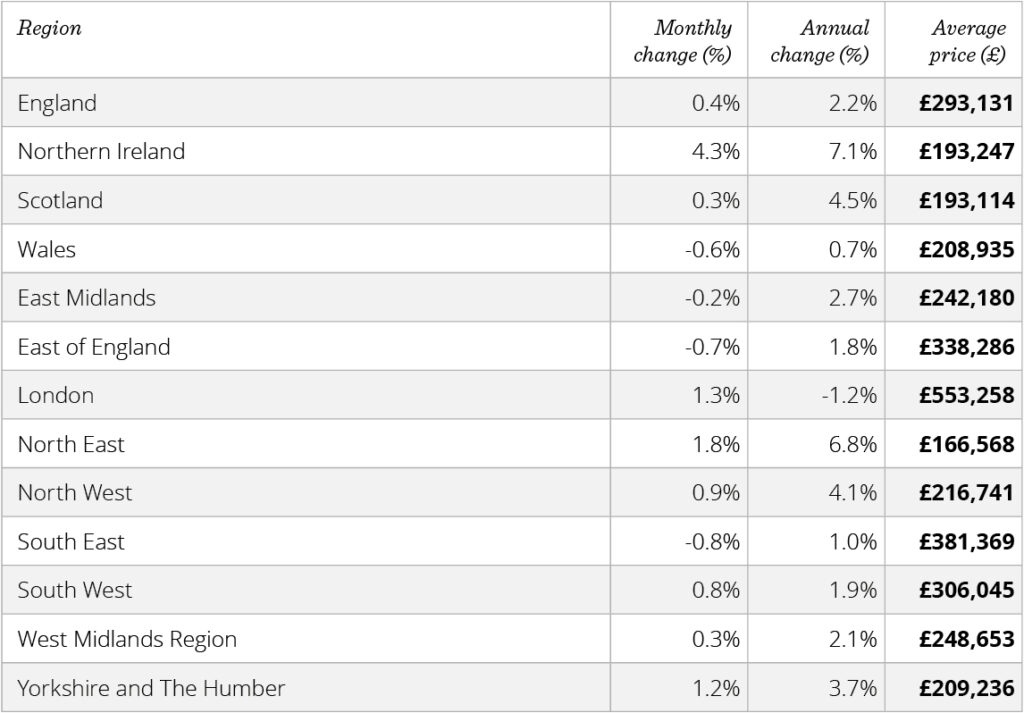

House prices unexpectedly fell by 0.6% last year, however they are anticipated to increase nationally by 2% in 2026 as affordability improves. Regional variations will persist, with stronger price growth expected in Scotland, Wales and the north of England. Meanwhile, London and the south of England will likely see slower growth.

First-time buyers may benefit from a greater supply of homes giving them more negotiating power. Plus, rent is rising at a slower annual pace, which may help prospective FTBs save up for their deposit. However, many new homeowners will still rely on help from the Bank of Mum and Dad to get on the property ladder.

At the very top end of the market, there may be some sluggishness – this is due to the new Mansion Tax on homes above £2m, which is due to come into effect in April 2028.

London prime market

According to data from Benham and Reeves, buyer demand in London’s prime property market increased in Q4 2025.

For homes in the capital valued between £2m and £10m, demand rose quarterly to 13.2% in Q4. This is up 1.2% on the previous quarter but down 1.3% when compared with the previous year. Chiswick recorded the strongest activity, with 43.3% of prime properties securing buyers. This represents an 11.4% quarterly increase. Islington and Putney followed closely behind, selling 42.4% and 42.2% of prime properties respectively.

Meanwhile, Battersea saw the sharpest decline in buyer demand (7.6%), followed by Clapham (5.3%) and Canary Wharf (4.2%).

Director of Benham and Reeves, Marc von Grundherr commented, “Despite the renewed noise around further taxation on higher value homes, prime London demand strengthened as we moved through the final quarter of the year, with buyers clearly prepared to act on the right property at the right price.”

Boxing Day activity reaches record high

Rightmove recorded its busiest ever Boxing Day in December 2025.

Housing activity typically recommences on 26 December after the festive season and 2025 was no exception. Rightmove reported a record number of site visits, with traffic rising 93% between Christmas Day and Boxing Day. This is bigger than 2024’s surge of 87%.

In the five days after Christmas, enquiries from those wanting to view homes rose by 67% when compared with the five days before Christmas. Over this same period, new property listings increased by 143%. The South East, East of England and London saw the highest levels of activity.

Steve Pimblett at Rightmove commented, “It’s early days, but Boxing Day’s data suggests agents could have a busy start to 2026 after a quieter festive period during December, which was also impacted by the lateness of the Budget and the uncertainty around potential policies in the lead up to it.”

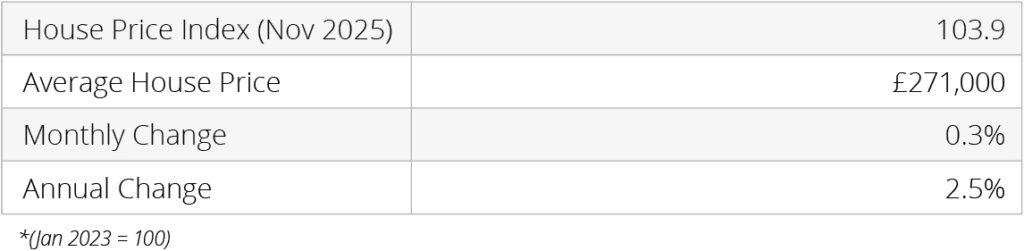

House prices headline statistics

- Average house prices in the UK increased by 2.5% in the year to November 2025

- House prices increased by 0.3% on average between October and December 2025

- The average house price in London was £553,258.

House prices – Price change by region

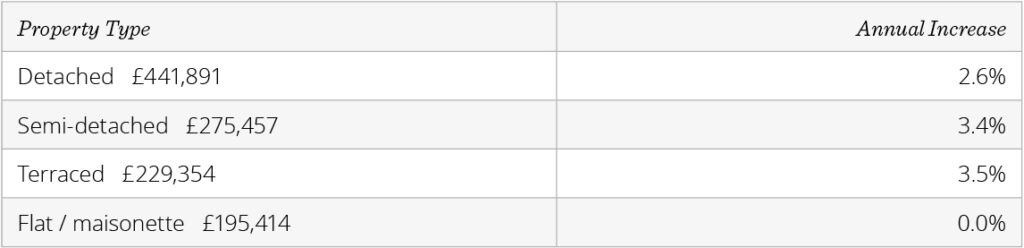

Average monthly price by property type – Nov 2025

All details are correct at the time of writing (21 January 2026)

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK.